by Ron | Dec 21, 2020 | free

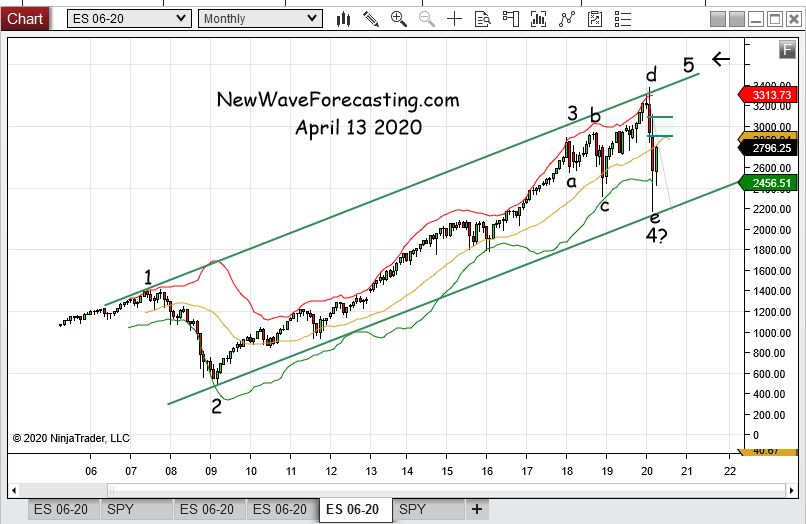

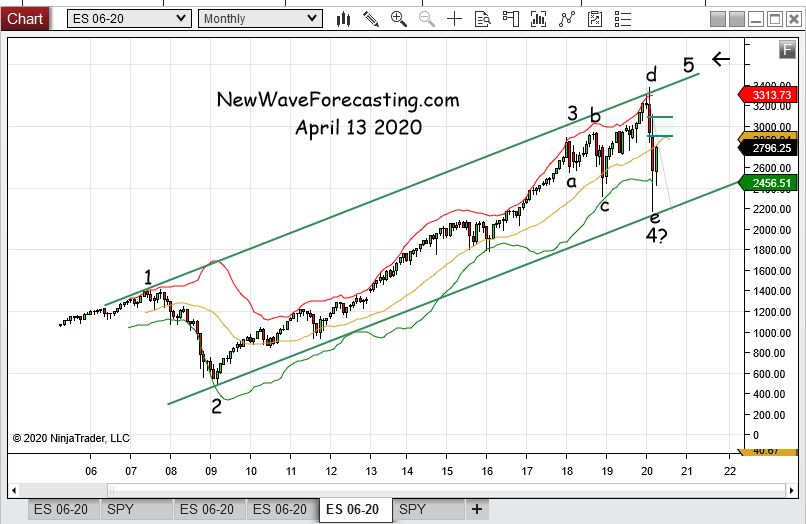

#SP The Case for New ALL TIME HIGHS I can’t count how many times during the day I hear talk about a re-test of the recent low. As no one else seems willing, I am here to talk about the realistic potential for a more significant test of the high and possibly more! Prices held the bottom of the up channel and did spring from below my 2350 downside objective. One possible Elliott Wave scenario to make this happen is pictured as an expanding fourth wave triangle. The upside retracements to watch are the bearish 62 just above 2900 and the more likely 76 near...

by Ron | Dec 21, 2020 | free

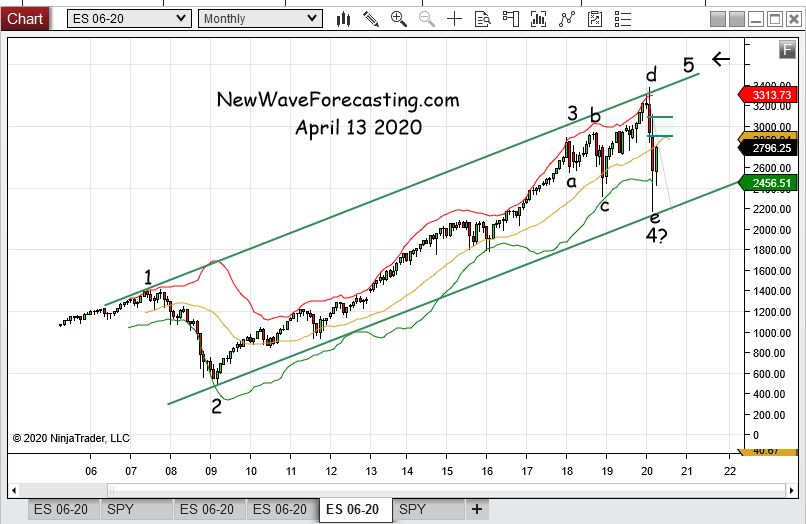

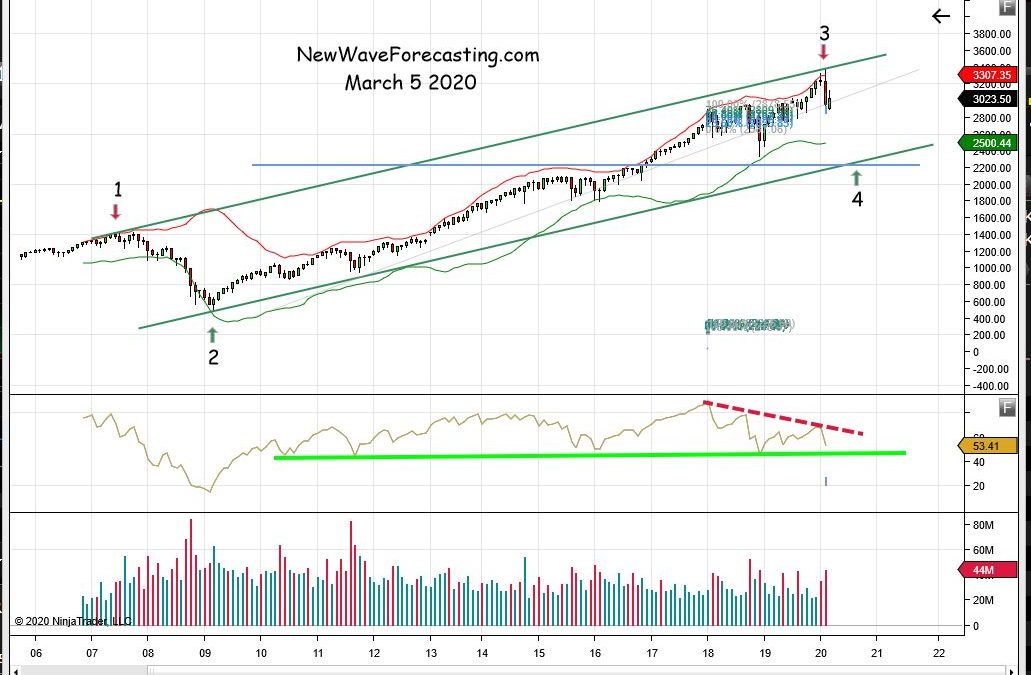

Last week I presented this long term count which actually suggests this debacle to be “sudden disappointment” in a long term bull market….Stand by as prices near weekly RSI support following the recent divergence on the...

by Ron | Dec 21, 2020 | free

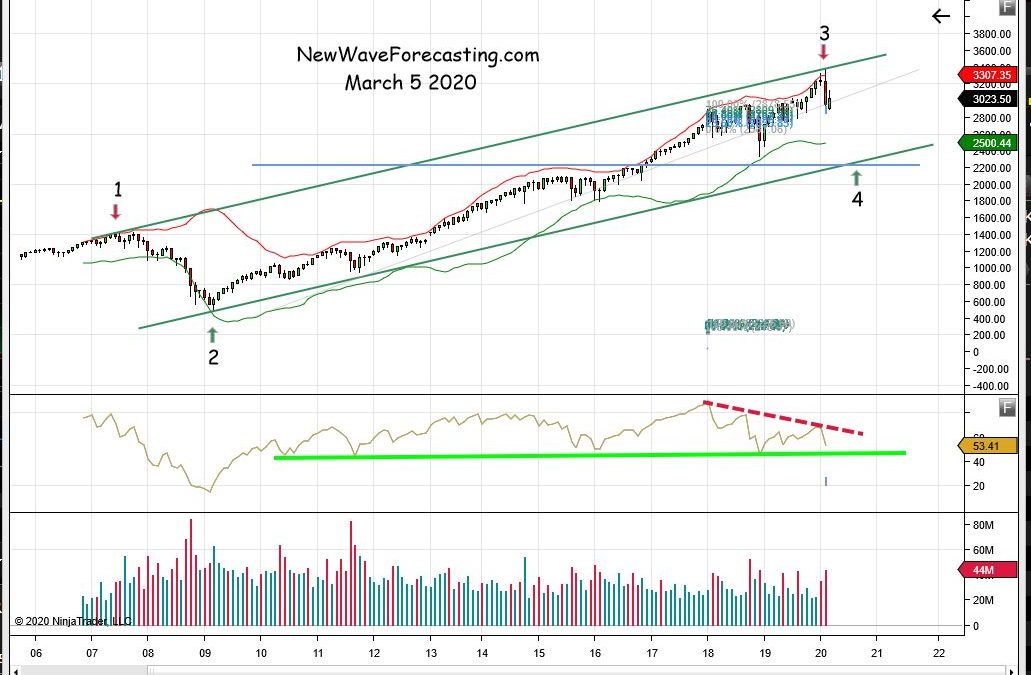

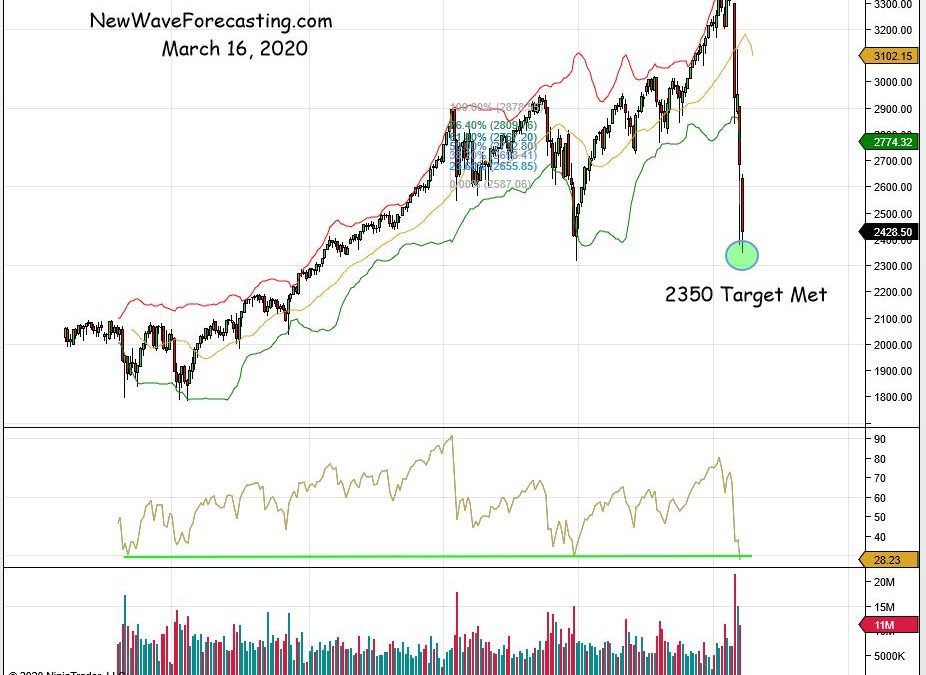

The case for SP 2350 #sp I believe there is no way to argue the recent price behavior to be corrective to the upside which supports the case for a fifth wave diagonal triangle top. The monthly RSI divergence is part of the scary scenario for a dramatic fourth wave correction. The fourth wave of smaller degree is fairly close to the bottom of the up channel as well as a 38% retracement. If 2350 is coming it is likely to happen in the next few...

by Ron | Mar 16, 2020 | free

by Ron | Jun 29, 2016 | NatGas

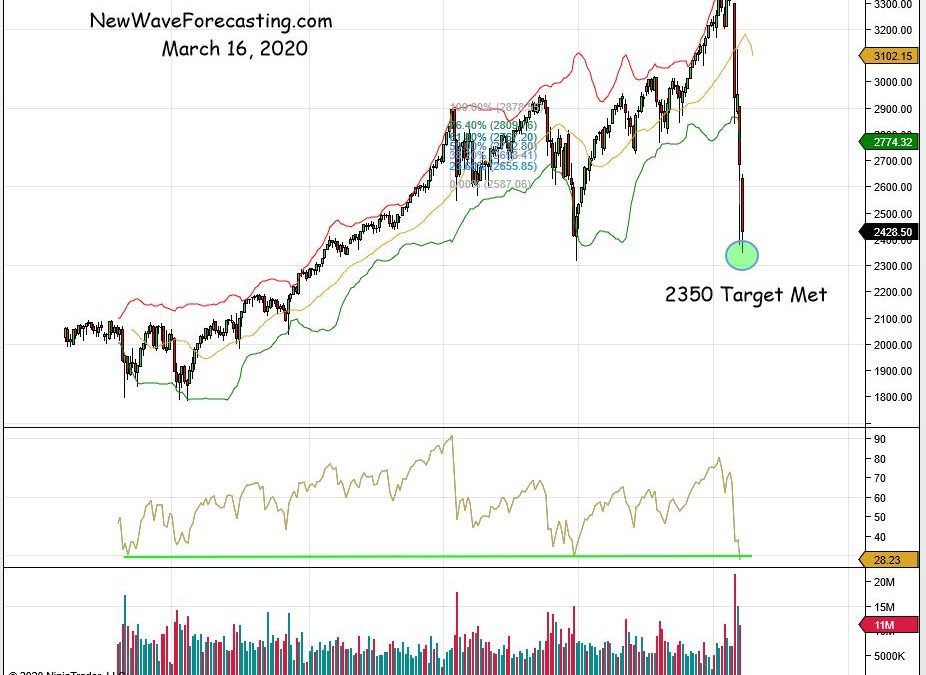

The back bone of the Elliott Wave Principle as applied to forecasting markets is the five wave impulse sequence. Sometimes we get lucky and I spot one. These are the exact charts and posts my subscribers received in REAL TIME! When I first assessed the situation it seemed only reasonable that the rising resistance line was going to come into play and may be the limiting factor to the five wave advance I was forecasting so this post went out at 7:30 AM CDT with prices at 2.835. “There ought to be a pair of 3-4’s coming on the way to the next wave 5 top” with a broad target zone of 2.88-2.95. At about 9:50 prices were at 2.839 following a run up to 2.87. I drilled down time frames and refined the road map a bit with an Elliott Channel but “the forecast remains the same-higher still”. At about 1:15 the market was trading 2.883 and I posted “The market is overbought and it hit the rising resistance line so perhaps wave iii has peaked or might do so with a bull trap above 2.90.” In addition “it is unlikely prices will trade below 2.82.” About 6:15 it seemed that everything was spot on and I shared “Ideally the small wave iv shakeout effort is now underway and...